Algorithmic trading (algo trading) has rapidly gained popularity among traders in India. It’s known for quick execution, reduced emotional trading, and efficiency. But a common question among traders is: “Is algo trading legal in India?” In this article, you’ll get a crystal-clear understanding of the legality, guidelines, and how you can safely engage in algorithmic trading in India.

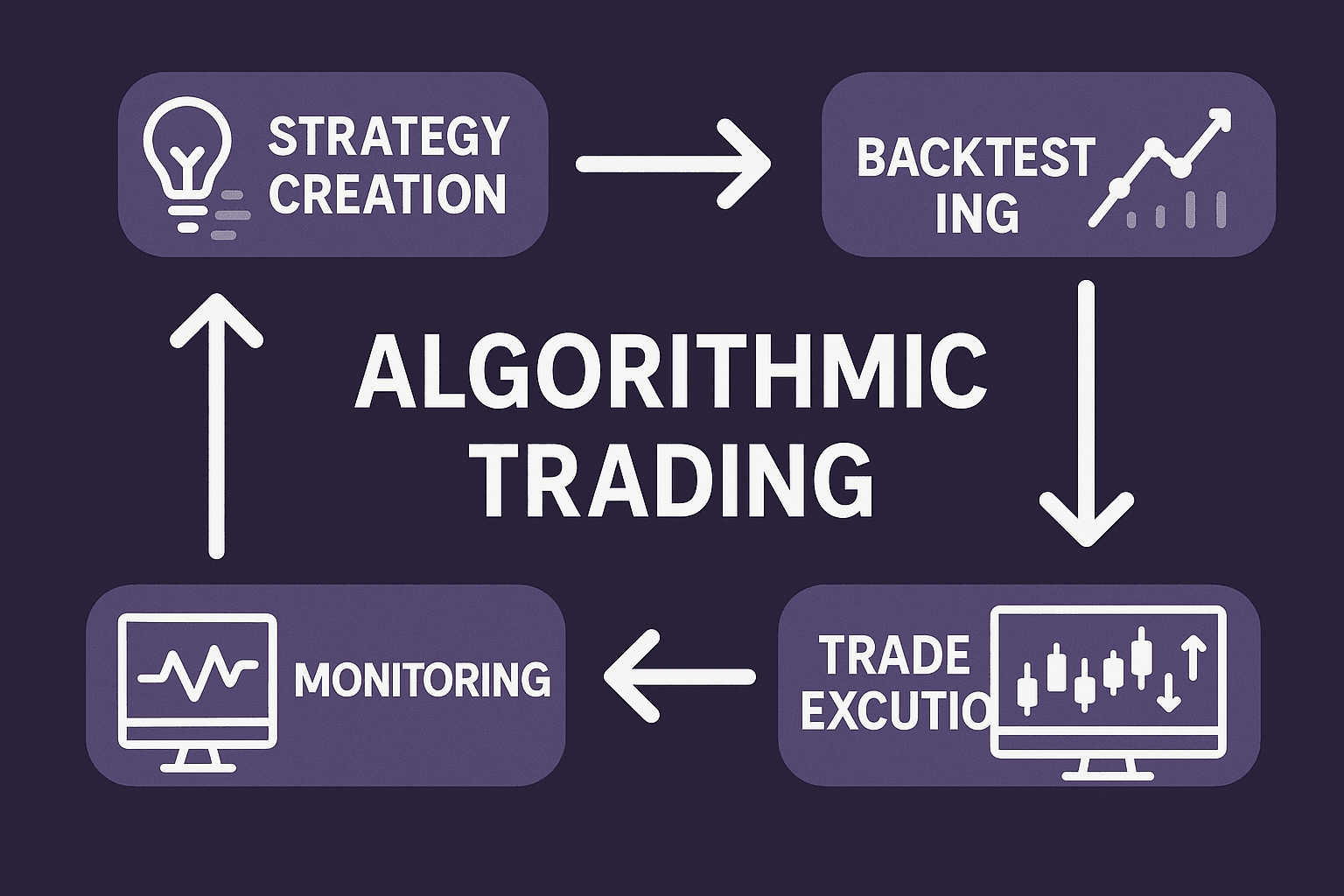

What Exactly is Algo Trading?

Algo trading involves using computer programs to execute trades based on predetermined criteria like price, timing, volume, and other market data. The primary advantage is speed—algo trades are executed instantly, helping traders leverage market opportunities effectively.

Is Algo Trading Legal in India?

Yes, algo trading is completely legal in India. The Securities and Exchange Board of India (SEBI), which regulates India’s financial markets, explicitly permits algorithmic trading. However, there are strict guidelines and compliance requirements that traders and brokerage firms must follow.

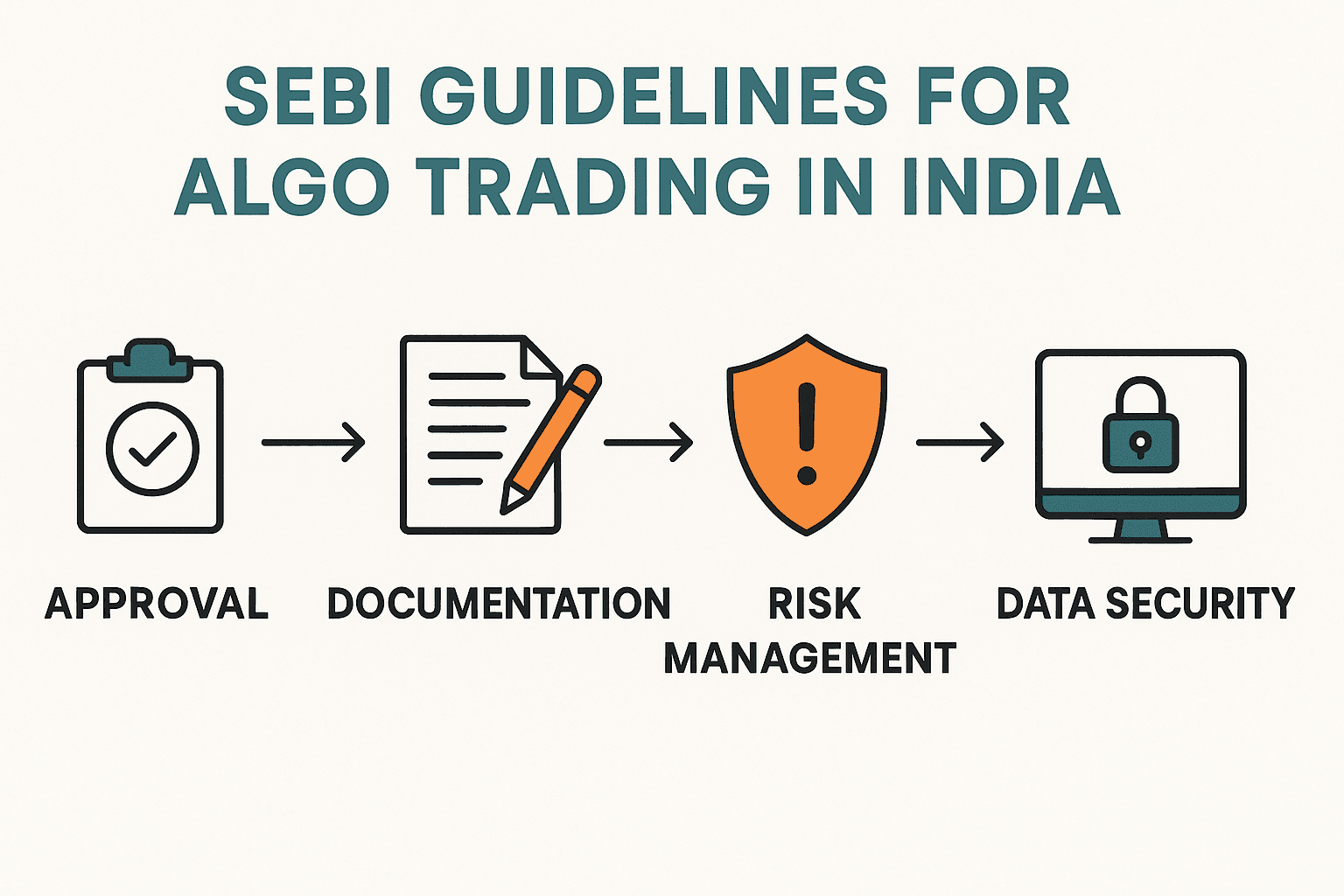

Key SEBI Guidelines for Algo Trading in India

To legally practice algo trading in India, you must adhere to SEBI’s detailed regulations:

1. Approval and Audit

Every algorithm must undergo prior approval and regular audits by the stock exchange. This helps ensure transparency and prevents market manipulation.

2. Risk Management

Brokers providing algo trading services must have robust risk management systems. This includes limits on order volumes, values, and clear mechanisms to handle system failures.

3. System Documentation

Traders and brokerage firms must maintain thorough documentation of their trading algorithms and strategies. SEBI may inspect these documents anytime.

4. Data Security

Algo trading platforms must have strict security protocols to protect against cyber threats. The integrity of trading data and client information must always remain secure.

Why SEBI Regulates Algo Trading

SEBI regulates algo trading primarily to:

- Prevent systemic risks.

- Ensure fairness and transparency.

- Protect investors from market manipulation.

Benefits of Legal Algo Trading in India

Here’s why legal algo trading is growing popular among traders in India:

- Efficiency and Speed: Trades execute rapidly, providing an edge in fast-moving markets.

- Reduced Emotion: Algorithms execute trades based on logic, removing emotional bias.

- Improved Accuracy: Reduces errors typically associated with manual trading.

- 24/7 Operation: Algorithms can monitor markets continuously, offering trading opportunities even when traders are away.

How to Start Algo Trading Legally in India

Getting started with legal algo trading in India involves these clear steps:

- Choose a Reputable Broker: Ensure the broker is SEBI-registered and offers approved algo trading platforms.

- Algorithm Approval: Submit your trading strategy to your broker for approval. It must comply with SEBI guidelines.

- Test Your Algo: Thoroughly back-test and forward-test your algorithm to verify its performance.

- Start Trading: Once approved and tested, your algo is ready to go live.

FAQs

1. Can retail traders practice algo trading in India?

Yes, retail traders can legally practice algo trading. However, they must use a SEBI-approved broker and comply with regulatory requirements.

2. What are the penalties for illegal algo trading?

Illegal algo trading can attract severe penalties, including hefty fines, suspension of trading licenses, and even legal prosecution.

3. Do I need programming skills to start algo trading?

Not necessarily. Many brokers offer user-friendly algo trading platforms and pre-built algorithms, minimizing the need for extensive programming knowledge.

4. Is High-Frequency Trading (HFT) legal in India?

Yes, high-frequency trading is legal but heavily regulated by SEBI. Traders must comply with stringent guidelines to engage in HFT.

Conclusion

Algo trading is entirely legal in India, provided traders comply with SEBI’s strict regulations. By adhering to these rules, you can safely and profitably leverage algorithmic trading to enhance your trading performance and accuracy.